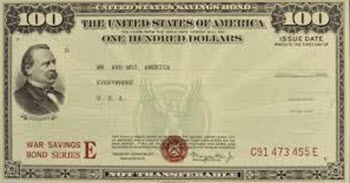

A government bond is a bond issued by a national government. The terms of these bonds can vary greatly, so it is important to investigate the T&C:s of a government bond before you make a purchase. The terms on which a government can manage to find buyers for its bonds varies depending on several factors, including the perceived creditworthiness of the issuing country in relation to other countries offering government bonds.

When a government issues a bond it will typically promise the bond owner two things:

When a government issues a bond it will typically promise the bond owner two things:

- To repay the face value of the bond on the bond’s maturity date.

- To pay periodic interest payments during the lifetime of the bond.

For some governmental bond, the interest payments are raffled out rather than paid out to each individual bond.

Risks

Government bonds are generally seen as low-risk investments, but that doesn’t mean that they are no-risk investments.

For starters, government bonds are usually denominated in currency of the the issuing country. This means that if the national currency is subjected to significant inflation, the face value of the bond may translate into very little in terms of purchasing power when the bond finally matures. Some governments issue inflation-indexed bonds for investors seeking protection against inflation. For these bonds, both maturity payment and interest payments are linked to a consumer price index.

It is also possible for a country to default on its debts. Russia did for instance default on its domestic currency debt in 1998.

This article was last updated on: January 18, 2016